deferred sales trust fees

Welcome to my scheduling page. The deferred sales trust DST is an established legal and proven tax-deferral strategy that can help you save thousands of dollars on the sale of your business practice or property.

An Ideal Alternative To The 1031 Exchange The Deferred Sales Trust With Brett Swarts

Based on a sliding scale with maximum fee of 15 of trust amount.

. The security and exchange commission sec does not put a limit on what sales load funds can charge but the financial industry regulatory authority finra does. On the 100000 the original seller receives each year they would only owe capital gains on 80000 because the gross profit ratio was 80 and the tax rate would vary depending on their. The legal and setup fees for establishing the Deferred Sales Trust would be approximately 15000.

Tax and trusts estates. One investment says If I understood you properly you make the transaction you defer 26 million in taxes youre left with 6 million. I want you to better understand how you can benefit from a deferred sales trust so you can make more money when you sell and have more freedom with your time.

Control of Funds At the close of escrow funds are transferred by escrow into the custody of a DACA account or a. The remaining funds will be reinvested to provide a consistent. So doing a DST.

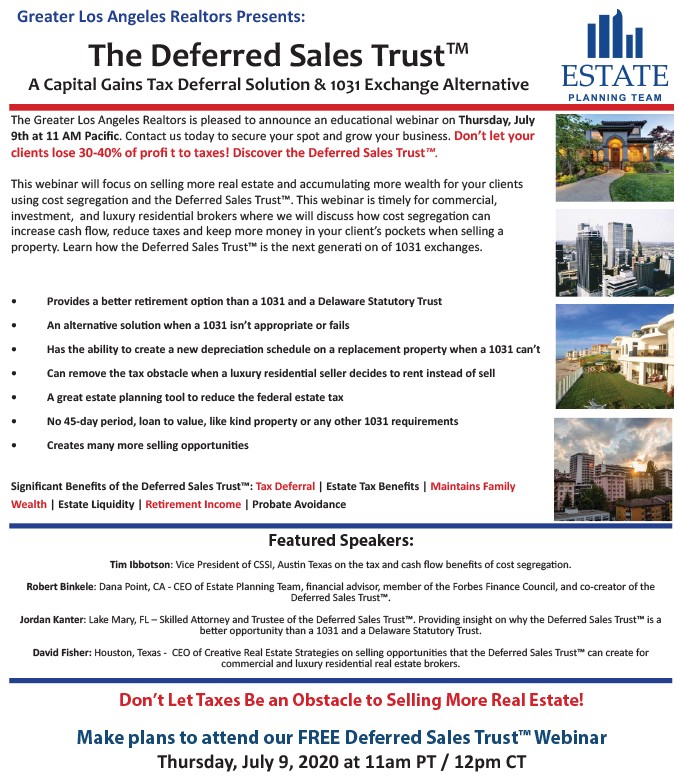

With that being said if you are working with an attorney who charges 250 per hour then the cost of preparing your living trust will probably be about 2500. Estate Planning Team provides exclusive access to market our proprietary capital gains tax deferral strategy the Deferred Sales Trust. Or perhaps youve come into.

Then I say Well what are 26 million in. Capital gains refer to the profit you made off your. I want you to.

Youve spent decades building your business. Please follow the instructions to add an event to my calendar. Fees to set up a DST are institutionally priced including the initial legal fees to set up the trust and the independent trustees fees all of which are disclosed in the engagement letter.

Youve taken risks that reaped rewards. By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a. With over 20 years in business Estate Planning.

Thats where the Deferred Sales Trust comes in. Youve worked for years to accumulate wealth. Pros of Deferred Sales Trust Tax Deferral Investors are able to defer the payment of capital gains taxes until a later date or when they receive principal payment.

Case 1 A married couple ready for retirement plans to sell their 1 million asset and will owe 250000 in capital gains tax. Assume that the sellertaxpayer wanted to invest his or her money so. A Zoom invite will be emailed with a conference call.

The deferred sales trust DST is a legal time-tested investment strategy to defer capital gains tax on the sale of your business or property.

What Are The Differences Between A Deferred Sales Trust Dst And A Charitable Remainder Trust Crt Reef Point Llc

Tax Deferral And Savings With A Deferred Sales Trust

Ep Nna 60 Why You Should Consider A Deferred Sales Trust With Brett Swarts We Close Notes

Start An Exchange Deferred Sales Trust

Deferred Sales Trusts Dst Montana Law Group

Deferred Sales Trust Vs 1031 Exchange Youtube

Deferred Sales Trust Legacy Legal

Deferred Sales Trust A Tax Plan Or A Product A Bit Of Both

Deferred Sales Trust O Connell Investment And Insurance Services

Deferred Sales Trust The 1031 Exchange Alternative

Advanced Planning Deferred Sales Trusts The Quantum Group

Facts About Deferred Sales Trust Finance Train

Using The Deferred Sales Trust In Preserving Capital And Limiting Taxable Gains Credo

%20(1).png)

Start An Exchange Deferred Sales Trust

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

Sell More Real Estate And Create More Real Estate Wealth Using The Dynamic Duo Cost Segregation And The Deferred Sales Trust Event On Glar

The Cost Of Setting Up A Deferred Sales Trust Is Too High Or Is It Reef Point Llc

Story Of How I Learned The Deferred Sales Trust Capital Gains Tax Solutions